The richest pastor in America pays no property taxes on his 18,000-square-foot Texas mansion thanks to a loophole in the state tax code, The Houston Chronicle reported.

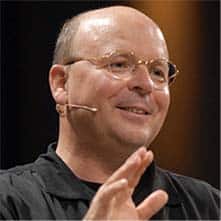

Televangelist and prosperity gospel preacher Kenneth Copeland, who is the leader of Eagle Mountain International Church in Tarrant County, Texas, has a reported net worth of $750 million. But because his mansion is considered a “parsonage” for the church under Texas Tax Code Sec. 11.20, the property is tax-exempt.

Classifying his home as a parsonage saves Copeland $150,000 a year in taxes on the $7 million home, Insider reported.

In a series of articles, the Chronicle also called out high-profile pastor I.V. Hilliard, bishop of New Life Christian Church, and area churches Nueva Iglesia Pureta del Cielo, Strong Tower Ministries (also known as Proverbs 18:10 Ministries) and Champions Community Church for their high-value yet tax-free clergy residences.

The tax code states that an organization that qualifies as religious is entitled to an exemption from taxation of “real property that is owned by the religious organization and is reasonably necessary for use as a residence” and is “used exclusively as a residence for those individuals whose principal occupation is to serve in the clergy of the religious organization” as long as it produces no revenue for the religious organization. It also restricts exempt property to less than an acre.

Your tax-deductible gift helps our journalists report the truth and hold Christian leaders and organizations accountable. Give a gift of $30 or more to The Roys Report this month, and you will receive a copy of “Hurt and Healed by the Church” by Ryan George. To donate, click here.

While Copeland’s house itself sits on an acre, he also owns 24 acres of surrounding lakefront property and pays just $3,000 in property taxes on that land.

Tarrant County Appraiser Jeff Law told the Chronicle that while Copeland’s house technically qualifies as a parsonage under the law “just like the little house next to the church,” it “definitely looks out of place and unusual compared to other parsonages we have.”

Law said that in response to the Chronicle’s investigation, he plans to ask Eagle Mountain to reapply for the parsonage exemption, a common procedure with churches.

Copeland built the six-bedroom home in 1999 and said in a 2015 sermon that God told him to build the house for his wife, telling him, “It is part of your prosperity.”

In a 2019 interview with Inside Edition, Copeland admitted to reporter Lisa Guerrero, “I’m a very wealthy man,” saying that some of his money came from natural gas reserves on his property.

He said because of its wealth, his ministry has been able to bring “over 122 million people to the Lord Jesus Christ.”

In a later interview, Copeland justified owning three private jets by saying, “If I flew commercial I’d have to stop 65 percent of what I’m doing.”

This story originally appeared at MinistryWatch.

Anne Stych is a freelance writer, copy editor, proofreader and content manager covering science, technology, retail, and nonprofits. She writes for American City Business Journals’ BizWomen and MinistryWatch.

Anne Stych is a freelance writer, copy editor, proofreader and content manager covering science, technology, retail, and nonprofits. She writes for American City Business Journals’ BizWomen and MinistryWatch.

11 Responses

I’m not defending Copland or any other clergy living in mansions but clergy do have to claim the fair rental value of a parsonage as income on their federal income taxes and they are liable for income taxes on that value. Some churches grossly undervalue their parsonages to lower the pastor’s tax burden. It would be interesting to know what Copland and others claim as income for their megaparsonages. But either the way the author intentionally left this out or didn’t do her homework because it’s simply not true that pastor’s don’t pay taxes on their parsonage.

Thanks for the perspective. You make good points, and I’m interested in the answers too.

Please review Ian’s statement online – it is inaccurate.

Ian,

It appears your statement is inaccurate – please review the following. This was a 1 second search.

In regards to taxes, if a minister lives in a church-provided parsonage, the minister is not subject to income taxes on the use of the parsonage. However, the fair rental value of the parsonage (plus utilities if paid by church) is added when figuring his self-employment tax.

The legal thing to do is not necessarily the moral thing to do.

“real property that is owned by the religious organization and is reasonably necessary for use as a residence”

I think the difficulty here is subjecting Copeland to what is reasonable.

While I’m badly put off by prosperity preachers, I’m guessing any religious leader’s home … whether a Pastor, Imam or Scie___ogy leader would get some similar tax break.

To me the Scie_____ists are reportedly some of the most deceptive and unfortunately are worth billions.

Maybe if he didn’t fly at all, he could stop 100% of what he is doing.

If you guys know a “Minister” more crooked and wicked than Kenneth Copeland, please let me know who he/she is! His very presence appears to be demonic in every way!

Wayne C,

He looks like a serpent, moves like a serpent, and talks like a serpent.

JMD or Joel Osteen?

Anyone with an ounce of spiritual wisdom can see what he is. He has received his reward in full.