This is a common refrain in my life right now but, I saw a thing on Twitter, now called X.

It’s un tuit from one of those anonymous-style accounts that post data on a pretty regular basis. (That’s a growing phenomenon, by the way, and I want some intrepid journalist to dig into that).

This one certainly caught my eye because it’s one aspect of religion that I tend to think about a lot and didn’t know if I could bring any data to the conversation.

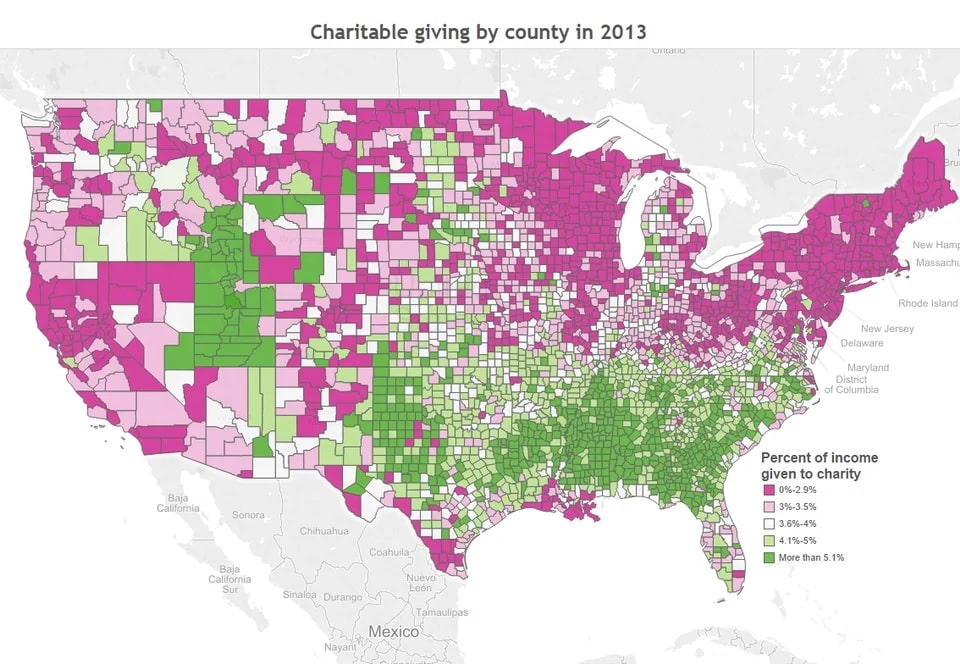

It was a county-level map of charitable giving. Holy cow, that’s a gold mine. But sometimes I see little data nuggets like this and I just can’t track down where the data comes from — or if I can find the data source, it’s not accessible to the average person. So, that ends my search. This one unfolded a bit differently.

I googled “Charitable Giving by County in 2013,” and I found the image again. But this time it had been posted on Reddit — 5 years ago. A quick scroll through the comments is the usual stuff about how this map is flawed because it includes giving to churches and that’s not really charity because they use their money to buy jets. (For the record, I think that Reddit is probably the most anti-religion social network right now).

Your tax-deductible gift helps our journalists report the truth and hold Christian leaders and organizations accountable. Give a gift of $30 or more to The Roys Report this month, and you will receive a copy of “Hurt and Healed by the Church” by Ryan George. To donate, haga clic aquí.

But one of the comentarios was from the person who made that map. Hallelujah. They linked to the story where the map first appears in the Sacramento Bee and then they also added a link to the data source. We have lift off.

I downloaded the data and started poking around. Of course it’s government data and all the variables are labeled in an indecipherable way, so I had to find the codebook. (This is why I use the same data sources over and over again, by the way — I don’t have to waste time looking up variable names). And I have something to share with you.

But before I replicate the map you see above, we have to take a huge detour into a change in the tax code. I know, exciting, right?

In 2017, Congress passed a bill called the Tax Cuts and Jobs Act, which did a whole bunch of things. The one that is most pertinent to this discussion is that it significantly raised the standard deduction. In 2016, it was $6,300 for single filers and $12,600 for those who were married and filing jointly. In 2017, those numbers jumped to $12,000 and $24,000, respectively. And they continue to creep up every year (they are $13,850 and $27,700 in 2023, for instance).

What does this have to do with charitable giving? A ton. One of the benefits of giving to a charity is that it reduces your income, and thus you pay a lower amount in taxes. However, there’s a big caveat with that. When filing taxes you have two choices — take the standard deduction or itemize your deductions. You should itemize only if all your items add up to more than the standard deduction. Those things include expenses related to education, health care and (you guessed it) charitable giving.

So, unless all the itemized deductions are north of $27,700 for a couple filing in 2023 — they should just take the standard deduction and move on. You know what that means? A whole lot fewer tax returns have any charitable contributions listed now than was the case back in 2013 because very few people give away so much money that they can itemize. The Tax Foundation reported that in 2016, about 80% of people making between $100K and $500K itemized. That share dropped to 32% by 2018.

The upshot of all of this is simple — we have way less data on the amount given to charity now than we did before the tax laws changed. That was something I had to figure out how to get around.

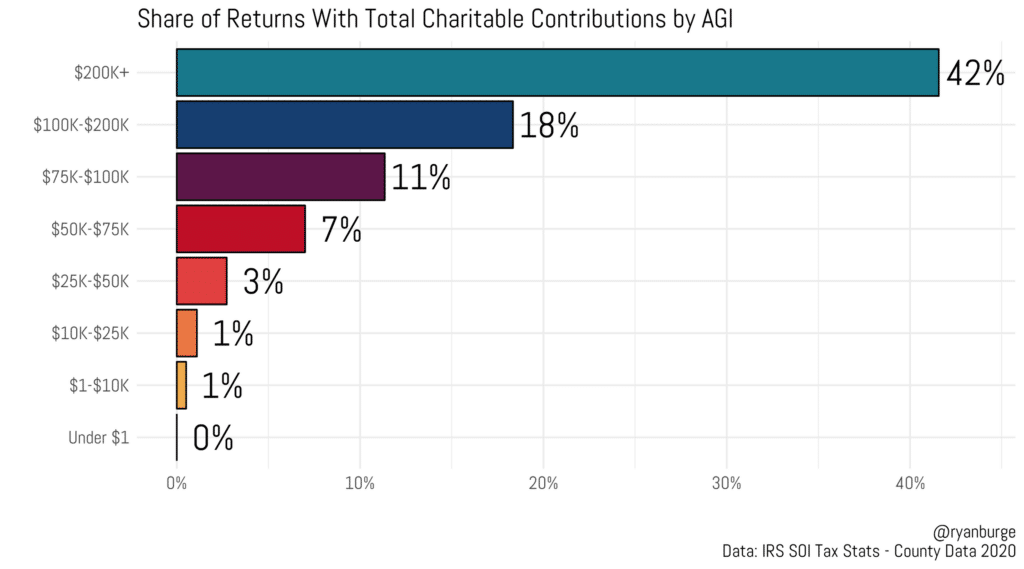

The above graph illustrates this problem quite nicely. Among people making less than $50K per year, almost none of them declared any charitable contributions on their tax returns. There’s a good reason for that. If they were married, the standard deduction is so high that all their itemized deductions would have to be more than half their income to justify reporting their charitable contributions.

However, for higher income individuals, the standard deduction is a smaller share. Among those making between $100K and $200K, 18% listed a charitable contribution, and for those making $200K or more, 42% listed charitable giving on their tax return.

The end result of that is that I cannot give you the complete picture of charitable giving in the United States. Lots of people at the bottom end of the income spectrum give money to nonprofits and churches, but almost none of them need to report that to the IRS. So, what I am going to show you going forward is the giving rates of people with higher incomes because that’s the best that I can do.

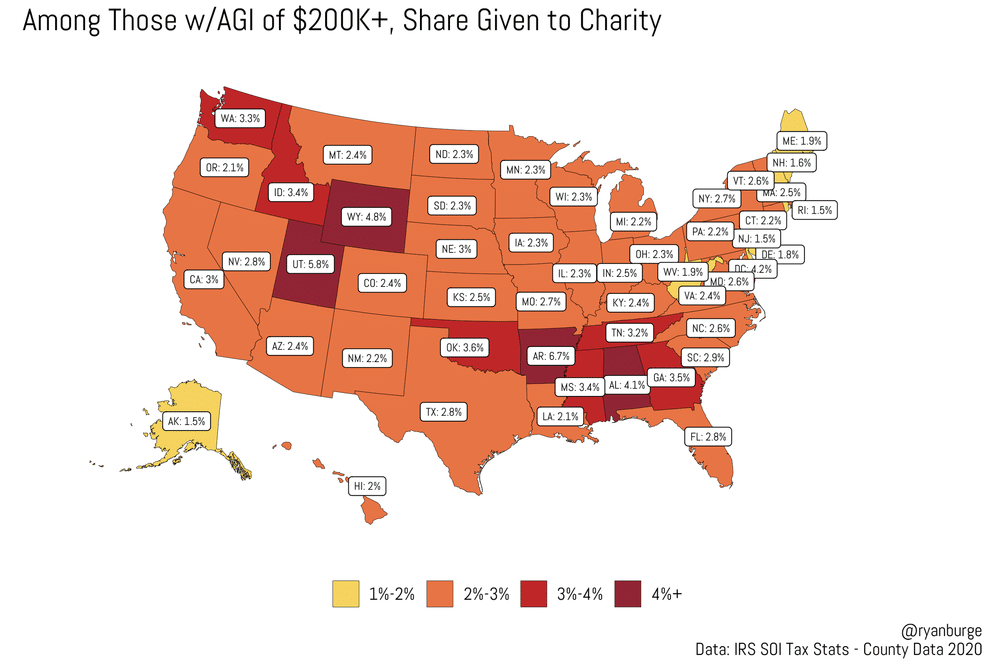

So, let’s get right to the map. I restricted my sample to just those whose income fell in to the top bucket ($200K or more per year), and this is aggregated at the state level.

Among high income folks, the ones who are the most generous are those living in two places — the South and the Mountain West. Arkansas has the highest rate of charitable giving at 6.7% of adjusted gross income. Utah is right behind at 5.8%. There are several other states that are north of 3%, though. They include: Georgia, Tennessee, Mississippi, Alabama, Oklahoma, Wyoming, Idaho, and Washington state and Washington, D.C.

Where are donations the lowest among the rich? That’s clearly the Northeast. Less than 2% of income goes to charity in states like New Jersey, Maine, New Hampshire, Rhode Island and Delaware. You can also throw Alaska into that mix, too.

But most of country is around 2-3%. That’s true across huge swaths of the Midwest and the Plains. But it’s also the case in California, Texas and Florida. I must caution readers that I don’t think it’s fair to assume that rich folks only give 2-3% away to charity — recall that this is just those who list charitable deductions on their tax return, and even among the top income bracket this is less than half of all returns.

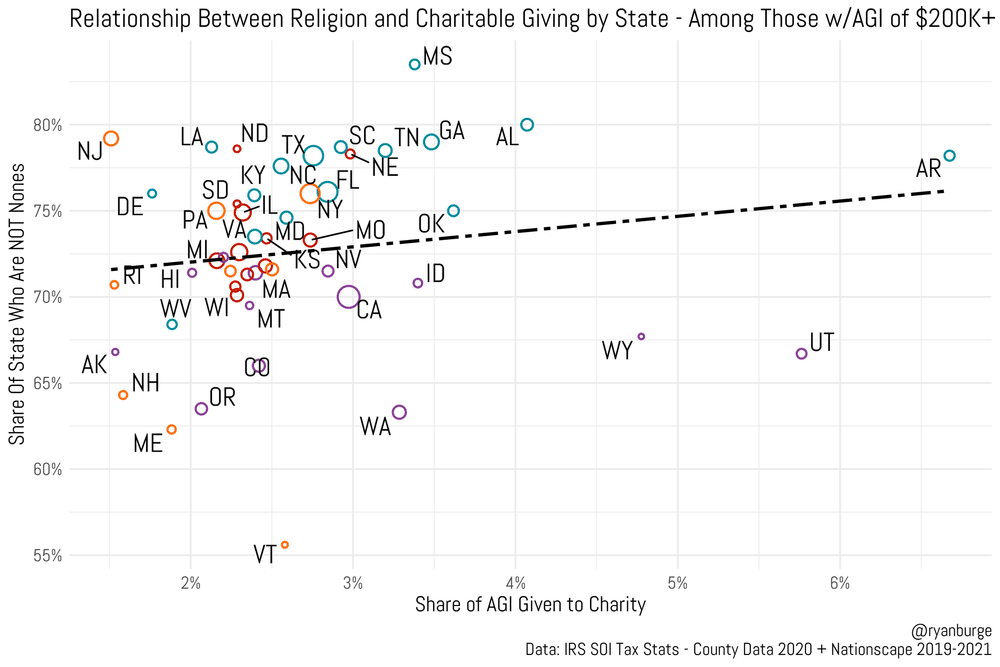

OK, so let’s get to the religion part, shall we? I used the Nationscape survey to estimate the share of each state that is not nones. These are people who described their religion as anything other than atheist, agnostic or nothing in particular. Do states that have higher rates of religious affiliation give more to charity (among those making $200K+)?

Yes — there is clearly a positive relationship between religion and charitable giving. But it’s not a huge difference. According to this trend line, a state with 72% religious folks should expect to see a 2% donation rate to charity. Among states with 76% religiosity, that rate rises to about 6.5%. But there are some issues with this, obviously.

One is that there’s just a not a ton of variation on the religiosity question. Almost all states are between 68%-78% religious. That makes these correlations difficult. Also, there are several states that are outliers — Arkansas, Utah and Wyoming are chief among them. When you only have 50 data points, three of them can really throw off the trend line.

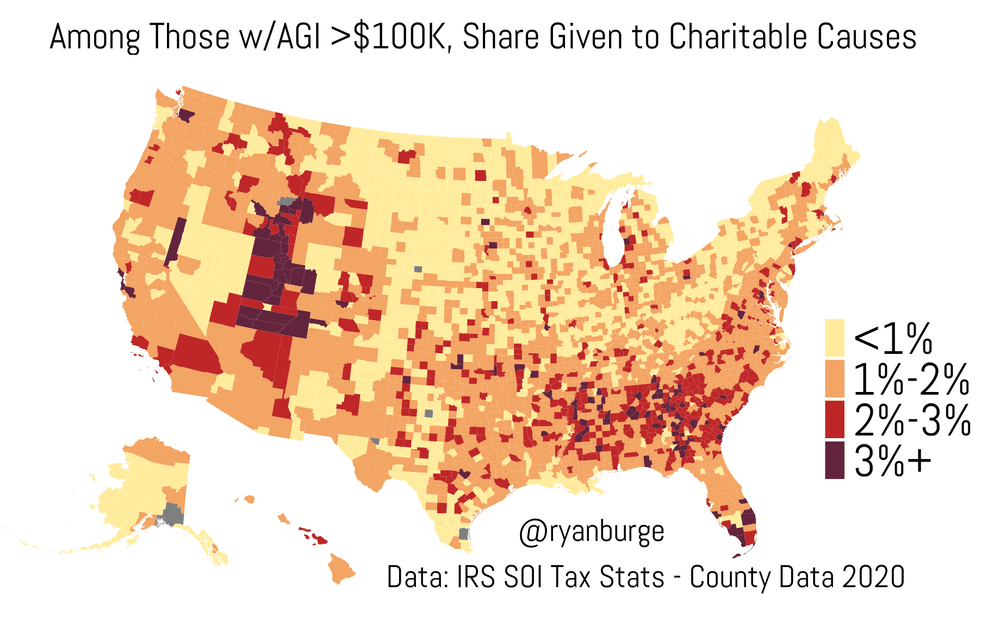

Let’s get more granular now and take a look at the county level results. This time I expanded my data to those making $100K or more. I did this to ensure that every county would have a sufficient number of tax returns to justify this type of analysis. This reflects the top two buckets of adjusted gross income reported by the IRS.

And the map here looks pretty darn similar to the one that I embedded in the tweet at the top of this post. There’s a strong concentration of charitable giving in places that are often considered the Bible Belt. In states like Mississippi, Alabama, Georgia, the Carolinas and Arkansas, there are some counties where giving is north of 3%. There are also lots of big time givers in South Florida, too, especially around Miami.

But there’s also a pocket out in Utah that ripples out into some of the surrounding areas like Wyoming and Southern Idaho. This is clearly due to the influence of the Church of Jesus Christ of Latter-day Saints. There’s no other explanation that makes any sense. But there are also pockets of darker red in places in Southern California and up through the Acela corridor in the Northeast, too.

I did want to note that the percentages in my data are much lower than those reported in the map posted above. Again, that’s because a lot more people needed to declare their charitable deductions a decade ago. That’s not because they were more generous; it’s because the laws were different. I can’t really assess that question effectively using this data because so few low income people report their giving anymore.

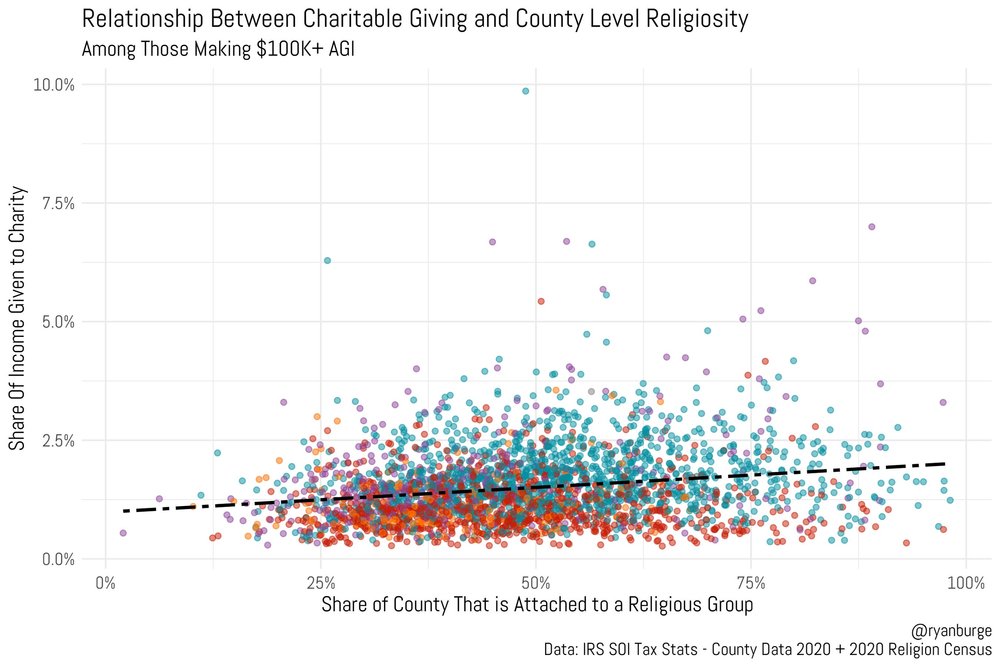

Let’s finish this with a scatter plot now with that county level data that I just calculated. This time I turned to the Religion Census to assess the overall religiosity of each county. This was done by calculating the share of each county that was attached to a religious body.

Again, there’s a positive relationship between the overall religiosity of a county and the amount of money that its residents give to charity (among those who make at least $100,000 per year in adjusted gross income). Among those counties where just 25% are part of a religious group, charitable giving is about 1.2% of income. Among those counties where religiosity gets above 80%, the share given to charity is closer to 2%.

Is 2% larger than 1.2%? Yes, it clearly is. But is it substantively that different? I don’t know if I can say that for certain. It does appear here that religious counties tend to be more generous than nonreligious counties, but it’s not like the gap is humongous.

Now, some people will look at this data and say, “See, religious people are more charitable than nonreligious ones.” I don’t know if I would go that far. I think a bit part of the explanation is a simple one — opportunities to give. If you go to church at all, it’s really easy to make a charitable donation. They pass the plate and you drop some dollars in there. No check to write. No website form to fill out. Easy peasy.

That reminds me of a paper by David Speed and Penny Egdell entitled, “Eternally Damned, Yet Socially Conscious? The Volunteerism of Canadian Atheists.” It addresses an interesting question: Are atheists just less inclined to volunteer than religious people? They summarize their findings like this:

The results suggest that atheists likely have fewer opportunities to volunteer but are similarly inclined to volunteer.

Making it easier to volunteer means folks are more likely to volunteer. Making it easier to give to charity means more money is given to charity.

The views expressed in this commentary, which was originally published at Ryan Burge’s “Graphs About Religion”, no reflejan necesariamente los de The Roys Report.

Ryan Burge es profesor asistente de ciencias políticas en la Universidad del Este de Illinois, pastor de la Iglesia Bautista Estadounidense y autor de “Los nones: de dónde vienen, quiénes son y hacia dónde van.”

Ryan Burge es profesor asistente de ciencias políticas en la Universidad del Este de Illinois, pastor de la Iglesia Bautista Estadounidense y autor de “Los nones: de dónde vienen, quiénes son y hacia dónde van.”

5 Respuestas

One question about the IRS data on charitable giving: I’m one of those people who regularly takes the standard deduction, so I report no charitable deductions. But I’m also 75, with a sizable RMD as part of my income, and virtually all my charitable giving is in the form of qualified charitable distributions. Are QCDs reported in the IRS data?

Ryan,

Thanks for the reporting.

I have reflected on this subject – since evangelical apologists like to toot this horn to substantiate their righteousness – evidently before man and God….

There is a critical factor that is missing – what is the difference between giving to one’s church and giving to a genuine charitable organization? The former is really simply giving to one’s self – one’s community – and propping up a facility and paying some fellow compensation for preaching at you….

As opposed to giving self-sacrificially….with no personal benefit in any way….

I suspect we would see a very different result.

Are contributions to American churches and mega churches actually “charity”?

Definitions from Oxford Language

char·i·ty

sustantivo

1. an organization set up to provide help and raise money for those in need.

Ex. “the charity provides practical help for homeless people”

2. the voluntary giving of help, typically in the form of money, to those in need.

Ex. “the care of the poor must not be left to private charity”

Granted most evangelical churches dedicate a small portion of their budgets to charity.

But we know the bulk of their operations are not dedicated to charitable causes, but rather staffing, building, projects, events, etc.

And are the motivations of those giving every week based on “charity” (helping the needy) or other motivations?

I would wager that a large proportion of their funds come from congregants who are tithing for selfish reasons- to avoid God’s curse or gain God’s blessing.

I’m not saying churches should not raise money or that people should not support their local churches.

I just don’t think those funds should be considered “charitable” contributions. Nor should they be a measure of how “charitable” church-going people are.

Reading through the comments on “charitable” contributions, I evaluated my own giving beyond the church and realized many did not fit the definitions – “help those in need.”

Yes, some met that definition – homeless shelters, world relief, toys for needy at Christmas, Salvation Army, etc. But my “charitable deductions” for museums, volunteer firehouse, friends group of a public gardens, a no kill animal shelter (maybe that is a needy location), a private Greenway (2,100 acre nature area), my university alma mater’s arboretum, etc. are not for the “needy.”

These and many more do not fit the needy “definition of charitable donation” but they are all tax deductable.

rafael,

I understand what you are saying. There are many, many types of charities. But my contention is that churches are not “charitable organizations.”

When you search “top rated charities” you can find many lists of many charities. They include all of the types of organizations you mention. But none of these lists include churches because churches do not fall within the definition of “charities.” (For example https://www.charitywatch.org/top-rated-charities). The closest you can find are organizations like Catholic Charities or Baptist Charities of America.

Churches are not included in those lists because churches are not considered charities.

And back to my point- I don’t think churchgoer’s tithes to churches should be tallied in statistics to determine the most “charitable” people in the nation.