Christ Covenant Church in Beaumont, Texas, has about 38 members on a good Sunday. For more than 25 years, the small Restoration Movement congregation about 40 miles from the Gulf of Mexico has been insured by Church Mutual, one of the largest of a handful of companies that specialize in insuring churches.

The 2023 premium was $6,810. It excluded windstorm and rising water damage, risky but not unusual for churches along the Texas Gulf Coast.

Then late last year, Christ Covenant learned Church Mutual had dropped its coverage.

“The reason we were given was we’re not worth the risk anymore,” elder Jake Pfaff said.

Though Christ Covenant’s story is a common one among churches in and beyond the coastal regions, the insurance maelstrom has hit Texas and Louisiana hard.

Your tax-deductible gift helps our journalists report the truth and hold Christian leaders and organizations accountable. Give a gift of $30 or more to The Roys Report this month, and you will receive a copy of “Baptistland: A Memoir of Abuse, Betrayal, and Transformation” by Christa Brown. To donate, haga clic aquí.

Mack McDonald is an elder and treasurer for the Glenmora Church of Christ, about 80 miles north of Lafayette, La.

McDonald said Church Mutual sent a letra “to everyone in Louisiana and maybe some in Texas that they weren’t going to do business here any longer. They said, ‘It’s not anything to do with what we think about y’all.’”

Just a business decision.

The church has never had an insurance claim.

Regardless, the bottom line for the congregation of about 80 members was a 44 percent increase in its premium after switching from Church Mutual to GuideOne, another of the larger church insurance specialty companies.

“The premiums with Church Mutual had gone from $9,268 to $10,692 over three years,” McDonald said. “With GuideOne, it went to $14,050.” The old and new policies both include wind and rising water coverage, but the deductible increased from $1,000 to $2,500.

The retired accountant said the impact is huge. “We were mullygrubbin’ pretty badly about the $9,000 or $10,000 we were paying, and then, ‘Bang!’”

Fortunately, contributions have been good, and the church has built up a surplus, McDonald said, “but we won’t be building up any more surpluses.”

Still, Glenmora fared better than Covenant, where Tollie Corder, Pfaff’s fellow elder and church treasurer, was able to get a new policy through SafePoint, a company that specializes in coastal regions of the U.S. but not necessarily in churches.

“But the premium went from $6,800 to $21,392,” Corder said, “and still does not include windstorm or rising water coverage. We are fortunate that we do not have a mortgage and are debt free. It still takes a chunk out of our budget, though.”

Beyond Texas and Louisiana, the Heritage Place Church of Christ in Irondale, Ala., had full fire and wind coverage with Nationwide for more than a decade for about $18,000. Reggie Johnson, the elder who deals with finances, said the church was told opening its doors to the community and posting pictures of activities on Facebook made its insurer aware of liabilities.

But the church also was told insurers were getting out of the business of insuring congregations its size. Heritage Place has about 200 members. An agent who attends there found other coverage, but the cost will increase to about $30,000.

Jennifer Johnson, spokeswoman for Church Mutual, said the company “is renewing and accepting new business in all states.” But John Ford, deputy commissioner of the Louisiana Department of Insurance, confirmed that the agency has a notice on file from Church Mutual withdrawing from Louisiana.

The state agency’s data reflect rate increases for other church insurers. GuideOne premiums jumped on average 3.8 percent since 2019 for fire and allied lines on commercial property, with an 8.7 percent increase for 2024. Brotherhood Mutual increases in the same category over the same time period have averaged 20.4 percent, with a 30.6 percent increase for 2024.

Anecdotally, that’s consistent with the experience of Texas churches. The Texas Department of Insurance does not have aggregate data on rate changes for churches but did confirm that none of the three church insurance companies has filed to withdraw from the state.

GuideOne, Brotherhood Mutual and Church Mutual are the largest of the insurance companies that specialize in churches.

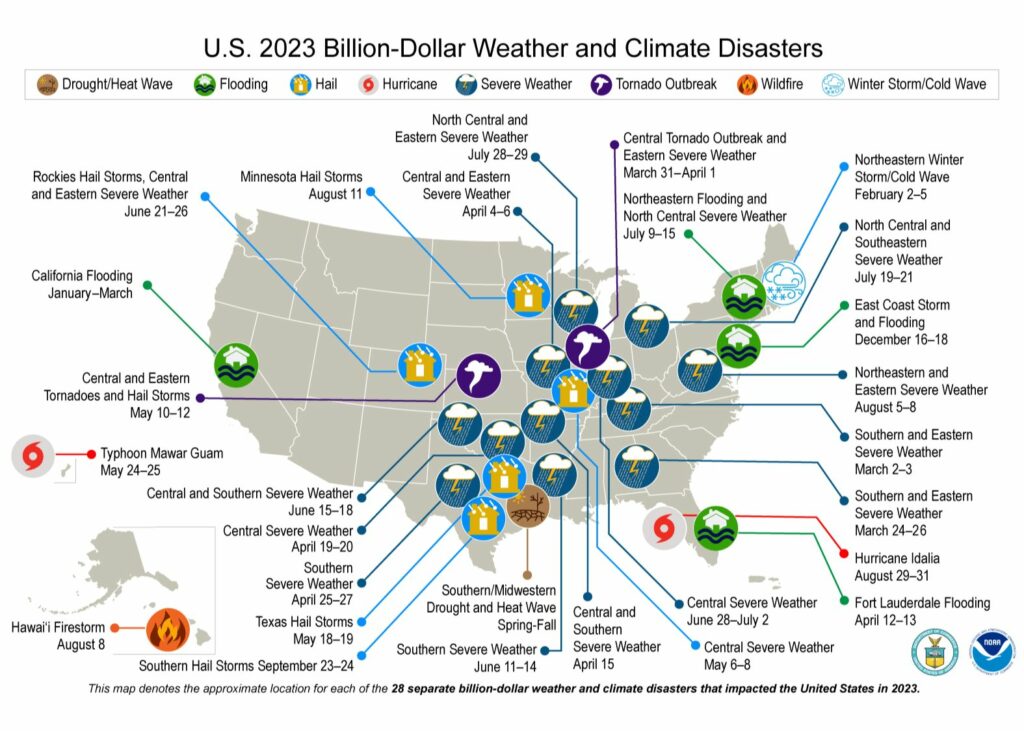

28 catastrophes of $1 billion or more

Churches aren’t the only ones with insurance problems. The Wall Street Journal recently published a lengthy story detailing the woes of the insured and insurers. Homeowners nationwide have experienced rate increases. Some of the biggest companies have taken major financial hits. Farmers pulled out of Florida, and last year, State Farm stopped offering homeowners coverage in California when the state denied its rate increase request. Others are expected to follow.

Loretta Worters, spokeswoman for the Insurance Information Institute, said rate increases have been most aggressive in California, Florida and the Gulf Coast in general. But she added, “It’s not specific to churches. It’s just properties at risk for wildfires, hurricanes, tornadoes” and similar events.

And last year saw more similar events than any year on record.

The National Oceanic and Atmospheric Administration reported a record number of billion-dollar disasters in the U.S. in 2023 — 28 in all. That includes a hurricane in Guam and fires in Hawaii. But the other 26 cut a swath across the country stretching from Texas to Maine, including flooding, hail, fire, a hurricane and severe weather events in summer and winter, leaving destruction and soaring insurance costs in their wake.

In central Texas, the Robinson Church of Christ in Waco was able to keep its premium the same after being dropped by Church Mutual and switching to GuideOne. But the church’s deductible increased to $40,000 because the policy calculates deductible as a percentage of coverage of the property.

The congregation has about 80 members, much smaller than before the pandemic, but its building seats 400. Tracy Mueck chairs Robinson’s church council, which handles administrative functions for the elders. She said, “We’re looking at what we need to have in surplus because we do live in a highly susceptible area for wind and hail.”

In West Texas, Suzetta Nutt, executive minister for Abilene’s Iglesia de Cristo de las Tierras Altas, said the church did not expect to be dropped by Church Mutual when it got an email hinting at a problem Sept. 28 of last year and one confirming the nonrenewal about two weeks later.

“They said they were declining to cover churches primarily in Texas and Florida because of the amount of weather-related claims those two states are experiencing,” Nutt said. “We didn’t have any catastrophic claims – it was a shock to us.”

Driven by mission, not insurance

Highland, with a Sunday morning attendance of 800 to 900, has a more complicated insurance scenario than most churches. Its main campus occupies 4.4 acres in the heart of Abilene. The congregation has two satellite campuses and 35 to 40 rental properties that provide low-income housing.

It’s a big church with a big bill. Still, when the cost just for property coverage went from 3 percent to 9 percent of Highland’s $2.1 million annual budget, that was a jolt.

“It’s a layered, very complex situation,” Nutt said, that includes liability policies, workers’ compensation and auto coverage for four church vans. She and others have worked through a broker to lower the cost by using multiple insurance companies to cover different pieces of the pie.

Churches today must consider coverage for sexual misconduct, active shooter liability and other liability issues if they have a school or daycare on site.

Worters at the Insurance Information Institute listed those among other challenges when insuring churches:

“How is the building being used? If any portion is rented or if they have a commercial kitchen, that can add to the cost. What kind of fire department protection is nearby? Are fire hydrants in close proximity – is there an adequate water supply?”

Insurers look at proximity to past natural disasters and how well the church has prepared for them.

Active shooter emergencies involving churches “were big in 2022 and for the last couple years, so when you have those huge increases in that kind of liability, that can impact a church as well,” Worters said.

And insurers want to know what churches and other organizations are doing to screen employees and volunteers.

“If there has been a problem, what have they done to address it? What kind of programs and facilities are there for children, and what kind of risk for abuse is there for those children?”

At least some of the services in Worter’s list of risks would prompt many church leaders to respond, “But that’s what churches do.”

Nutt said Highland plans to keep being a church that is mission-driven.

Highland is committed to “letting our mission and vision for serving God’s people in Abilene and around the world be the driving factor and not insurance,” Nutt said.

The final nail – out of cash

But not every church has the resources to turn on that dime. The Hyde Park Church of Christ in Austin, Texas, where James Tackett is an elder, had just changed to Church Mutual last year and now has been informed it’s being dropped.

Tackett is not sure how much longer the 90-plus-year-old congregation — second oldest in Austin – is going to last.

“Right now we’re at less than 40. … At one time we were close to 500,” Tackett said.

The nonrenewal notice “said lack of building maintenance or something like that,” the elder said. “But we don’t know of any inspection being done. … We are going to contest it.”

The church also is considering selling off some residentially zoned lots or some sort of merger with another dwindling congregation, but Tackett’s tone is not optimistic.

“We don’t see insurance as being the final nail,” he said. “Our final nail is just running out of cash.”

Not every church that has been dropped by its insurer was with a company specializing in church coverage.

los Orient Street Church of Christ in Stamford, Texas, north of Abilene, was dropped by Nationwide. Mike Holt, an elder there, said its premium was about $18,000, but the church was dropped in July 2022 and told it was because it was in a high crime area. Statistics for the town of about 3,000 show its crime rate to be below national averages and below similar nearby towns. Orient Street switched to Liberty Mutual — for about $30,000.

An independent insurance agent in Lubbock was able to help the 70-member congregation find coverage. Jeff Shropshire, president and owner of Shropshire Insurance, works with about 50 churches, mostly in Texas, and with hundreds of insurance companies, including GuideOne, but he doesn’t write a lot with them. The bulk of his business is not church-related.

“A number of years ago in my territory they quit writing wind and hail – that takes them out of the picture for West Texas,” Shropshire said.

Shropshire said in the current market, churches can expect one of two things to happen — nonrenewal or a dramatic increase in premiums. Many factors are part of that, but much of it comes down to weather events.

Jared Morgan of Benton, Kentucky, offered a similar explanation. He owns American Church Group of Alabama, Kentucky and Tennessee, and another traditional agency that focuses on homeowners. American Church Group is a national franchise of church insurance specialists that is partially owned by Brotherhood Mutual.

Morgan said that through 2019, property claims were stable but trending up and inflation was fairly stable in construction costs. Those numbers matter to companies that mainly insure churches because 85% of claims on churches are related to property. Catastrophic weather affects companies that primarily insure churches more than those who also have auto and comp.

From 2020 through 2023, each year was worse than the previous year, Morgan said, “and in 2023, every day in May and June there was a catastrophic property loss somewhere in the U.S.”

Further complicating matters, from 2020 to 2021, construction costs increased 50 percent. That means if a church was insured for $100,000, the cost of replacement was $150,000.

Those kinds of numbers also cause reinsurance to go up. And here’s where understanding insurance gets challenging.

los National Association of Insurance Companies describes reinsurance as insurance for insurance companies. Essentially, the insurance company transfers a portion of its risk to the reinsurance company.

But, like a homeowner’s policy, the risk is capped. So when the number of catastrophes and the cost of construction go up, insurance companies have to pay more out of their operating surplus. In 2023, Morgan said, the entire industry surplus dropped.

When that happens, he added, companies make drastic changes. One of those changes heading into 2024 is that Church Mutual dropped over 1,000 churches just in Texas according to one of the emails the company sent to Highland.

‘We have no property insurance’

In Biloxi, Miss., the 35-member Rodenberg Church of Christ has no insurance on its building. Bill Denton, preacher and elder, said losing insurance is old news there.

It may be a forecast of storms ahead for churches elsewhere.

“We lost insurance on the property after Hurricane Katrina. We do have liability but nothing on our building,” Denton said. The church didn’t get any water in its building during Katrina, but “we’re close enough.”

Denton can walk out the church’s front door and see the Gulf of Mexico.

“We have no property insurance. We can’t get property insurance. … They dropped all the businesses and churches along Highway 90.”

In 2020, Hurricane Zeta destroyed the roofs of Rodenberg’s main building and its fellowship hall. Another church helped replace them.

Este artículo apareció originalmente en La crónica cristiana.

Cheryl Mann Bacon is a Christian Chronicle contributing editor who served for 20 years as chair of the Department of Journalism and Mass Communication at Abilene Christian University.

2 Respuestas

During the civil rights movement, churches who got involved had their fire insurance cancelled. Voter registration efforts took place at US Post Offices rather than churches as a result.

Expect to see a lot of smaller churches either merge with larger ones or, if they have surplus real estate, sell it to pay the bills, including insurance coverage. Unless churches with small, declining congregations have endowments or funds left to them via wills or trusts, they won’t be able to continue to pay the increasing insurance bills, or bills in general that are being driven upwards by inflation.