Since 1998, evangelical ministries with combined assets of more than $700 million have stopped filing the Form 990 which discloses critical financial information for donors.

Tax-exempt 501(c)3 entities including Christian ministries are obligated by the Internal Revenue Service (IRS) to annually file Form 990, which reports how nonprofit money is being spent. But major evangelical ministries including Billy Graham Evangelistic Association, Focus on the Family*, Compassion International, and the International House of Prayer-Kansas City have sidestepped filing 990s in recent years.

Media ministries are merging with churches or requesting the IRS reclassify themselves as churches or church integrated auxiliaries to avoid disclosing compensation of key leadership, legal expenses, and travel expenses because churches and similar organizations (synagogues and mosques) are exempt from filing.

In 2005, IRS Commissioner Mark Everson sent a letter to Senator Chuck Grassley claiming that because churches were not required to file an informational return, “we have little ability to monitor their operations against diversion of assets.”

The following spreadsheet features a list of 21 non-profits and trade names that are still operational along with the last fiscal year they filed a Form 990.

Your tax-deductible gift helps our journalists report the truth and hold Christian leaders and organizations accountable. Give a gift of $30 or more to The Roys Report this month, and you will receive a copy of “Hurt and Healed by the Church” by Ryan George. To donate, click here.

The trend may have begun with Jimmy Swaggart Ministries which merged with Family Worship Center Church in 1997. The ministry’s 990s from the mid-1990s are not available online.

After the merger, Swaggart’s church registered Jimmy Swaggart Ministries as a trade name. This allows the church to perform business and to have a bank account in the name of Jimmy Swaggart Ministries.

More recently, the Billy Graham Evangelistic Association (BGEA) filed for a group exemption which was granted in 2014. The BGEA’s final 990 covering 2014 reported $258,677 in compensation for the ministry’s president Franklin Graham. BGEA no longer discloses Graham’s compensation. Also, in 2014 Graham received $629,821 in compensation from Samaritan’s Purse, another non-profit where he serves as president.

For donors concerned about excessive compensation, it is impossible to make informed decisions when compensation information is not available to the public.

Understanding the Process

When a new non-profit organization applies for tax-exempt status or an existing non-profit applies for reclassification, the Internal Revenue Service (IRS) examines the application and responds with a determination letter which is posted on the IRS website.

While churches are not required to obtain a tax-exemption, some will apply because IRS approval is helpful for obtaining loans.

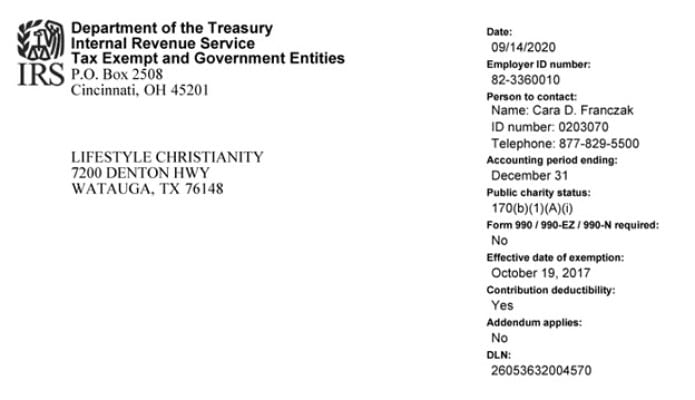

The following photo shows part of the determination letter sent to Lifestyle Christianity and indicates the ministry is no longer required to file a 990.

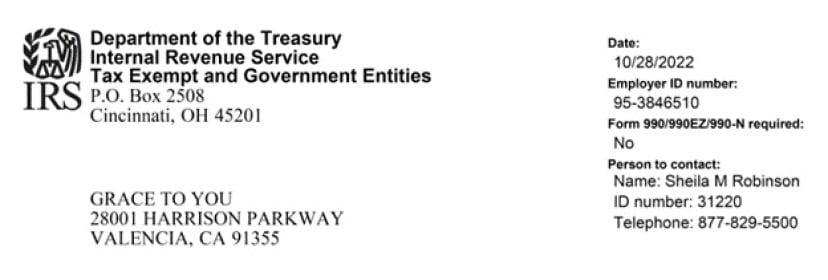

In 2022, the IRS reclassified Grace to You, the media ministry of Pastor John MacArthur, as a public charity and exempted the ministry from filing a 990.

When the IRS revokes a non-profit organization’s tax-exempt status, a revocation letter is sent to the organization but not published on the IRS website. Instead, revocation letters are private. Their contents are kept secret by the 1974 Privacy Act.

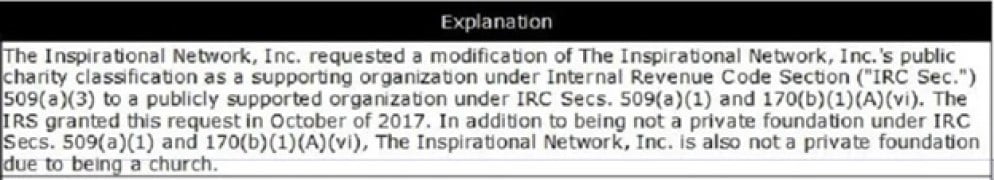

Sometimes a non-profit organization will disclose on 990 that it has applied for reclassification. The following explanation appears on a 990 for The Inspirational Network, which is the non-profit ministry of televangelist David Cerullo.

Integrated Auxiliaries

The IRS website reports, “The term integrated auxiliary of a church refers to a class of organizations that are related to a church or convention or association of churches, but are not such organizations themselves.”

Because integrated auxiliaries of churches are exempt from reporting requirements of the Form 990, many televangelists use this method to avoid financial disclosure.

Televangelists and large megachurches register trade names [also known as assumed names, fictitious business names and doing business as (DBAs)] for media ministries and church-run schools.

In 2011, a memo prepared for Senator Chuck Grassley and the Senate Finance Committee reported, “For example, we found at least 21 ‘assumed names’ registered with the State of Texas for Eagle Mountain International Church (also known as Kenneth Copeland Ministries). These included record companies and recording studios. This raises the question of whether church status is being gamed to shield such activities of a tax-exempt entity from public scrutiny.”

IRS Enforcement Actions Are Ineffective

Church status provides the perfect cover for scheming religious broadcasters and televangelists.

After The Word Network CEO Kevin Adell, received more than $15 million in compensation in three years through self-dealing, the IRS revoked the tax-exempt status of World Religious Relief, the parent organization of his TV network.

Adell responded to the IRS audit and revocation by creating Church of the Word and registering the trade name Word Network Church. Adell is free to operate as before but with even less transparency.

In 2021, the IRS revoked the tax-exempt status of televangelist David E Taylor’s Joshua Media Ministry International.

Meanwhile, Taylor’s church has registered two trade names in Texas: Campus for the Harvest and JMMI International Global.

In 2023, David E. Taylor’s church purchased a 67-unit hotel and added the name JMMI International Global to the outside of the building.

In 2022, Taylor’s church purchased an $8.3 million mansion and guest house in Tampa, Florida, which functions as a tax-exempt parsonage.

Meanwhile, Taylor’s church does not disclose travel costs between Florida, Missouri and Texas or total assets acquired in the three states.

Rejection of Reforms

In 2011, a memo prepared for Senator Chuck Grassley and the Senate Finance Committee disclosed a willingness by the Senate to impose minimal reporting requirements for churches:

“Requiring some version of the Form 990-N, ‘e-postcard’, which was implemented in 2007, was one idea. It only requires basic information such as federal employer identification number, name, address, and a contact person for the organization.

We considered limiting the exception to churches that provided members with some voting rights.”

The memo also disclosed:

“We also considered limiting the filing exception for those subject to denominational oversight or oversight by an independent third party, such as the ECFA. We also considered requiring churches to publicly disclose only certain information, such as related entities and policies and procedures. Finally, we considered eliminating the integrated auxiliary exception.”

Senator Grassley asked the Evangelical Council for Financial Accountability to establish a commission to study the loopholes exploited by religious organizations and offer solutions. One of the questions for the commission was “Should new entities claiming church status at least be required to notify the IRS of its intent to claim church status?”

ECFA’s commission responded:

“Congress should never pass legislation requiring churches to file Form 990 or any similar information return or form with the federal government. To require such a filing would not only place a substantial and unnecessary burden on churches and the government, it would also raise significant constitutional concerns. New churches should not have registration or notification requirements beyond those that already exist.”

It should surprise no one that ECFA’s commission defended the status quo because attorneys of televangelists served on the commission’s panel of legal experts. Reportedly, the ECFA ignored significant red flags when it accredited Harvest Bible Chapel, which was later revoked.

*Update 4/16/24: Following its reclassification in 2021, Focus on the Family has continued to prepare Form 990 for each tax year, which are available on the ministry’s website.

*Update 4/22/24: Voice of the Martyrs has been removed from the spreadsheet above. The ministry to persecuted Christians does produce a Form 990, which is available on request, but not through the IRS database or ProPublica. VOM posts audited financial reports online here, which includes board members’ names and executive compensation.

This article was originally published by Trinity Foundation.

Barry Bowen is a staff member of Trinity Foundation, a public nonprofit based in Dallas, Texas that has been tracking religious fraud and helping victims for over 30 years.

14 Responses

great report. how a ministry spends their money is very important, however whats 1000 times MORE important is WHO is giving the money and how much they are giving. this will show who actually runs and owns the pastors and ministries and who is calling the shots as to what the preacher will preach about and what issues they will push. IMO a few multi millionaires and billionaires are controlling these ministries, I guarentee you thier money does not come from little old ladies sending them $15 a month!. Keep us informed!, THANKS!

nothing says “American evangelical” like a 8 mil parsonages. yes, being humble servants of the lord we MUST show God loves us by living in places that can house many many people. If it was a parsonage vs Mcmansion. ahhhhhhhhhhhhhh to be loved by God more than other people. Its what we do best at convincing others how God loves us best.

William:

One’s possessions and wealth are never a barometer of God’s love. Jesus, God’s Son, was poor. He didn’t even have a place to lay his head.

This article did not reveal any illegal activity. It did reveal the need for closer IRS scrutiny when it comes to churches and “integrated auxiliaries” of churches.

You missed my point. These scamvangelicals should be living a humble life not setting the example of he who dies with the most toys wins. Changing from mega mansions to humble homes is needed. The Uber wealthy pastors seem to only manifest in America. I’ve done some research. It’s mostly an American evangelical way of life. Humility in life style is not practiced in the USA USA USA.

William,

When Jesus died, Joseph of Arimathea provided his burial tomb. Both Joseph and Nicodemus, members of the Sanhedrin, were apparently wealthy and willing to use their resources to honor God’s Son.

It is not helpful, in my opinion, to denigrate those who are wealthy. Jesus never did. He only warned that, for the wealthy, entering heaven would be difficult. “Changing from mega mansions to humble homes is needed” is a statement that reflects the idea that money is somehow evil.

It’s not. It is the LOVE of money that is wrong. Often, those with money use it to help those without money. Wealthy Christians also tend to support missionaries who otherwise would not be able to serve in other countries around the world.

Also, keep in mind that Jesus spent time with all, including those with money. Zaccheus is a great example of this.

The USA is a wealthy country and, because of this very fact, many nations around the world have benefitted from our generosity.

Cynthia, I don’t believe you understand William’s point-or you are deflecting. Though he’s a bit snarky in his comments his point is worth consideration. Why do these televangelists need expensive mansions? Of course they don’t. But they do have them. What really is at issue is the motivation of their hearts, which is in God’s purview. But it’s not hard to discern. The real damage is in what the world sees and concludes. Clearly William has been impacted by what he sees.

This is the point you miss or don’t wish to see. You are correct that being wealthy in its self is not morally wrong. But you also point out that it’s the love of money that is destructive to the soul. Perhaps here is where William’s argument should fall for your consideration.

things, especially financial things, do not have to be illegal to be unethical and immoral.

christians should be above reproach, especially with money, not hiding assets and finding loopholes.

using the US tax code as the litmus test is like using the mafia to arbitate crime. the US tax code is highly manipulated to favor the wealthy and the grifter. and it’s working out for these shady “christian” orgs.

jen:

I agree with you when it comes to unethical and immoral uses of one’s resources. Christian pastors should be above reproach.

However, the U. S. tax code actually lets about 40% of American citizens pay no income tax at all. Do you think that’s “favoring the wealthy” or “favoring the grifter” ?

Here are a few facts for you:

“In 2020, the latest year with available data, the top 1 percent of income earners earned 22 percent of all income and paid 42 percent of all federal income taxes – more than the bottom 90 percent combined.”

Only the beginning of Jesus’ cleansing of the Temple once again.

I have seen where a church is registered as a “non-profit” but has never filed a IRS 990 form. It is registered under the name of the original founder who is no longer at the church; he is now the lead pastor at another church in Washington state. So, why would a church register as a non-profit? What advantage does that have? As time when on, founding pastor laid down greater and greater hurdles for people to see the church finances. It was reverse transparency in just about every aspect of the ministry. And yes, that church is still operational.

All about the benjamins, baby.

There’s a gaping hole in this article. Many ministries and organizations choose to claim church status to be able to hire and fire employees based on their ministry belief and practice statements. It’s called the “Ministerial Exemption”. Thus they avoid discrimination lawsuits from potential or discharged employees who hold views or practice lifestyles out of compliance with the ministry belief and practice statements. I think every 501c3 should be required to file a 990 every year. Those who don’t shouldn’t be trusted, including your local church/synagogue/mosque. Your motto should be “no transparency, no money”. Trust AND verify.

Grifters gonna grift. It’s gross that so many american evangelicals are getting rich off “charity”.

Jesus would be flipping every single one of these tables for sure. Jesus wasn’t about loopholes and tax breaks and hiding money.

Listen, man. The tithers, in my opinion, ALWAYS have a right to know where their money is going. ALWAYS.

The biggest problem I see with the evangelical church/associations…is not being willing to disclose every penny. Yes, every penny.

Those who don’t…I can almost guarantee you that there’s a power&control problem (from the TOP down) in that church/org. It’s DANGEROUS.

Even with 990 disclosures…evangelical churches are very very vague in showing where the money is going.

Find a place that has open books and you’ll find a much more simple ministry…your faith will be simplified…and you’ll grow in the things that REALLY matter. And I’ll bet it’s a church/organization that is making a difference at the ground level!

Don’t forget, we’re here to shine LIGHT, folks. His Light. Not the lights from the concert stage where you’re worshipping on a Sunday morning.