Churches and other not-for-profit organizations must now report salaries and parachute payments over $1 million due to a new IRS rule aimed at discouraging excessive compensation, which was recently finalized.

In its February 16th Bulletin, the IRS announced an update to section 4960 of the Internal Tax Code taxing nonprofits and churches that pay “covered employees” more than $1 million in wages, or provide excessive parachute payments. (The IRS defines “covered employees” as the top five highest-compensated employees of the organization.)

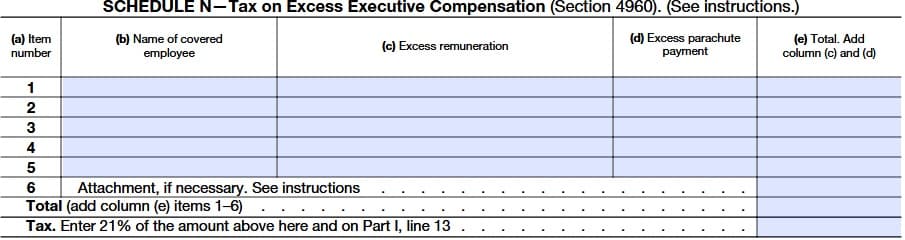

When these employees receive more than $1 million in wages or excessive parachute payments, the nonprofit must file a Form 4720 Schedule N. The nonprofit must then pay a 21% tax on the excessive compensation.

The five top-paid employees of nonprofits are typically listed on a Form 990 filed with the IRS. In 2018, the IRS modified the Form 990, revealing if organizations have paid an excise tax on payments of more than $1 million. Excise payments are indicated on page 5, line 15 of the Form 990.

Churches are exempt from filing 990s. But they are not exempt from reporting excessive compensation, according to an IRS official in the executive compensation department who spoke with the Trinity Foundation.

Your tax-deductible gift helps our journalists report the truth and hold Christian leaders and organizations accountable. Give a gift of $30 or more to The Roys Report this month, and you will receive a copy of “Hurt and Healed by the Church” by Ryan George. To donate, click here.

Trinity Foundation examined a list of highly paid compensated ministry leaders published by MinistryWatch, a Christian donor watchdog group, and determined that Inspirational Network, High Point University and Educational Media Foundation (K-Love) pay the excise tax.

Hillsdale College and Glory of Zion International (Chuck Pierce) so far do not report paying the excise tax, even though both feature an executive receiving more than $1 million in compensation. This is not proof of wrongdoing because some compensation is exempt from the excise tax, such as an organization carrying liability insurance on an employee.

This excise tax penalizes excessive wages, not fees. If a pastor is paid to perform a wedding, for example, the income is considered a fee and is not subject to an excise tax.

Besides excessive wages, the IRS also treats parachute payments as a form of excessive compensation.

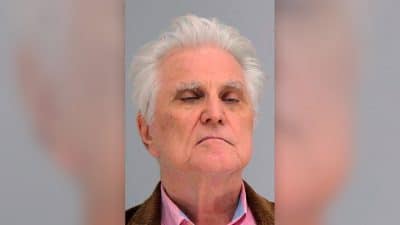

An example of this would be the $10.5 million in parachute payments that Jerry Falwell Jr. is reportedly set to receive from Liberty University, following his resignation as president last year. According to The Wall Street Journal, “Mr. Falwell is due his $1.25 million salary for two years, followed by a lump-sum payment of about $8 million, because of a clause in his contract that allowed him to resign with full pay if his responsibilities were curtailed.”

Trinity Foundation estimates Liberty University will pay a tax penalty of $1,530,383 on golden parachute payments of $10.5 million.

Future Form 990 filings by Liberty will show whether or not an excise tax is paid on the parachute payments.

Barry Bowen is a researcher and writer with Trinity Foundation.

Barry Bowen is a researcher and writer with Trinity Foundation.

21 Responses

Here comes the spirit of Lois Lerner; yes, the same IRS (what a coincidence) that BLOCKED Conservative groups 503 request,,,while rubber stamping leftists groups for election campaigns. She even used Government computers to send Government emails, lambasting Conservatives (that means Christians, like Julie Roys) and calling them “a**holes”. When called to testify in front of the Senate, she took…..the 5th. She promptly retired, with over $100K in bonus. Tax payers’ money. Those hard drives that contained the rest of her emails were……destroyed….accidentally. Just as the FBI and all those Government employees’ phones were…wiped……accidentally….by entering the wrong passwords…….accidentally……10 times or more. Those phones were used to “investigate” the over $30 million so called “Russia Collusion” investigation on President Donald Trump (Orange Man Bad for the Never Trumpers).

And here comes the IRS….just as promised by the Leftists. Their end justifies their means. Eventually, they are going to REMOVE any exceptions from ALL Christian ministries……unless they accept the leftists’ “Equity and Equality” doctrine into their Churches. The TRUE church better get ready to go underground.

Microsoft and others, will be be willing to “block” computers from anyone that doesn’t comply.

Trojan Horses on the near horizon. The Communist Chinese are taking it to the bank. Just ask Mitch McConnell’s wife.

Uwe

(Jude 3)

Post Tenebras Lux

I guess you must feel better getting that off your chest, but it has nothing to do with content of the article.

If Christian ministries would pay fair and livable salaries, these things would be a non-issue. The love of money is a root of all kinds of evil.

So, it’s now up to the Gov’t to determine salaries for the church? Wow.

It is because the leaders of these churches agreed to become a 501c-3 corporation and signed on the dotted line giving Caesar control. Read the documentation and you will see it is all there in black and white. One cannot sign a contract with the govt and think they are not going to call in their chips one day.

Where in the new IRS rule does it say they have the right to determine salaries for the church? Ministries are still free to pay their executives and pastors whatever they want — even $100 million/year.

Perhaps if the ECFA wasn’t just a rubber stamp body, this move to (slightly) increase accountability wouldn’t have been necessary.

I honestly find it difficult for any ministry (whether church or faith-based non-profit) to be able to justify a salary for anyone even approaching $1,000,000. As a pastor for over 35 years and having led churches both large and urban as well as small and rural, the men and women I know in ministry are all underpaid and often work multiple jobs to allow them to continue in their ministries. I can’t imagine any ministry leader thinking its acceptable to receive this sort of compensation. And for there to apparently being enough doing so to warrant the IRS requiring this special form to be filed blows my mind.

I agree with you for the most part. However, I’m bothered by the IRS addressing charities, but not corporations. If people learn that a ministry CEO gets too much money, they can stop giving to it. Perhaps people don’t inquire about leadership salaries, but that’s their problem, not the problem of the IRS.

If you are a shareholder of any corporation, you gave the right to request that info.

The reason states regulate charities to prevent fraud. They are supposed to be open so donors can see what’s going on with the charity.

Churches snuck in exemptions so no one saw how much money they were making.

You fail to realize that many of these so-called ministries adamantly refuse to provide such information even when their own members or staffers ask for it.

I wonder if the fact that Church’s are tax exempt has anything to do with it. I know that many corporations find ways to pay little or no taxes but they are required to pay taxes.

With the amount of money that mega church’s bring in I think that they should be required to pay their fair share as they do use use the communities’ infrastructure.

I imagine that when the exemptions were established, nobody was thinking of non-profit as being lucrative. But here we are.

Yeah, most people don’t realize that “non-profit” encompasses a far wider range of organizations than “charity”. A lot of Texans were recently surprised to find out that the organization created to manage the supply and demand of the state power grid, ERCOT, is a non-profit, with executive salaries in the range of $200k to $500k.

A non-profit designed to protect the profits of the power supply and delivery companies…

One way to avoid making a profit is to funnel all the money into compensation packages for the executives.

That’s because Mark you are a teacher of Gods word. Meaning a man of God. They are profit centers and entertainers and pick a scripture then add there opinion then show anger management issues and impulse control issues while yelling (and jeeeesusss is lorrrrrrd) and close with reminding the audience that it’s pay to play or Gods is gonna get ya. See the difference Paster Mark Conn. I hope so. I was under there spell then God reminded me that he also talks to me and to use his discernment in all things. Ya know. Wolf in sheep’s clothing stuff.

I am not sure I agree with the government taxing anything involving ministry. I will say I would question any Ministry leaders true motivation in ministry if they are making a million plus in salary unless they were giving A LOT to other ministries!

Once upon a time such salaries would have been unimaginable. Churches have become mega businesses for profit. And with opportunities come opportunists. Opportunists are creating business. Selling God as a product & profit. You cannot sell God or what belongs to Him! Good Lord. That is the pure definition of plagiarism. They’ve become Money Changers 2021 AD. The lines between business/secular/church are completely blurred. Some claim religious status strictly for financial gain, such as Scientology (aka Church of Scientology). And this, this is Lois Lerner 2.0… and salary is a red-herring. It specifically targets charities – not corporations. But I can’t help but think God is totally fed up; apostasy, false profits profiting. While I don’t expect pastors to live like paupers, when I see $1M+ salaries and all the luxury accoutrements, how is it not about money? It’s like the gorgeous young girl with an old rich guy old enough to be her father or granddad, and saying it’s ‘true-love’…. Riiight.

The Evangelical Council for Financial Accountability (ECFA) was created in 1979 to head off government regulation that would have required some level of financial accountability in the aftermath of a bunch of scandals involving the misuse of ministry and charitable funds.

As Julie has plainly shown through her reporting over the last few years, the ECFA isn’t going it’s job and is little more than a rubber stamp at this point, only denying certification long after the horse has bolted.

This move by the IRS doesn’t change the way ministries are taxed, it’s designed (slightly) increase the type of accountability the ECFA should have been requiring over the last 40 years.

This has been a long time coming, although this article points out that there are always loop holes and these malignant narcissists that we idolize do not have real boards so they will do their best to utilize them to stay under the legal limit while actually taking more. And the amount is currently much too high. No one who runs a charity needs a six figure salary but they set this at 7.

God can fix this by introducing hyper inflation into our economy and fixing that problem. To me this is certainly coming because our government has gone nuts with pulling huge sums of money out of thin air and then giving it to everyone to spend. In the past many governments have tried to do just this and it has always ended badly but we never learn anything important from history…

Given the agreement Falwell had with Liberty makes me wonder if he had intentionally set up his exit strategy all along knowing this was coming down the pike expecting a big payday.

Mark Conn, I agree with your insight and statement. (Thumbs up)

Public companies submit annual reports and other regular reports on their sources and uses of funds. But most mega church or high profile ministry would refuse to provide disclosure on how its leaders are using their funds. If a “ministry” refuses to provide these reports then one should ask if one should continue to give.

Moving forward, one should always ask a pastor, elder, choir director, church staff, missionary, employee of a christian institution …What’s in it for you ? What was your average income in the last 5 years before you decide to join the “ministry” ? How much do you expect to be paid and gain materially from your “ministry” ? If there are royalties from books, sermons etc. who gets it you or the church ? If you’re going to Africa as a missionary, shouldn’t you be paid African mean cost of living standards or do you expect American standard of living while ministering in Africa ? How much of my giving actually goes to the beneficiary and how much goes to pay overhead ? Do you plan to fly first class or buy a private jet ? Are your children or any family members on the board or have contracts with the ministry ? and if its not too much to ask …how many houses you plan to acquire from doing ministry?

If they can’t offer a straight, truthful, factual answer… God will be pleased if you head straight to the nearest food bank ran by volunteers and give your money for the hungry and needy.