Classical Conversations Inc. (CC), a leading homeschool education company, is knowingly exposing unsuspecting churches that host its programs to major tax liabilities, according to a California pastor, several former CC directors, and tax and legal professionals who recently spoke with The Roys Report.

Because most local CC programs are for-profit businesses, using a church’s tax-exempt building and assets can jeopardize the property tax exemption granted to that church. Yet most CC programs meet in churches. And many churches and local CC directors seem unaware of the potential danger.

Tim Brown, senior pastor of Calvary Chapel Fremont in the San Francisco Bay area, said he first became aware of the issue in 2018. That’s when Calvary Chapel received a $27,000 property tax bill related to a local CC chapter that used the church building for weekly homeschool meetings.

The county then “back assessed” the church for the previous two years, bringing the total to $85,000, Brown said—a fact verified in documents obtained by The Roys Report.

Brown then remembered information CC had sent Calvary Chapel when the church first began hosting the CC program, stating that the church now had “membership” with Alliance Defending Freedom (ADF), a legal group which defends challenges to religious freedom.

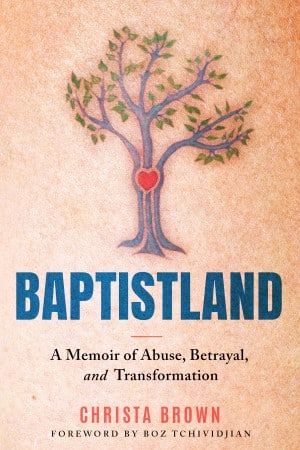

Your tax-deductible gift helps our journalists report the truth and hold Christian leaders and organizations accountable. Give a gift of $30 or more to The Roys Report this month, and you will receive a copy of “Baptistland: A Memoir of Abuse, Betrayal, and Transformation” by Christa Brown. To donate, click here.

On its website, CC defines ADF’s role as “(helping) churches navigate and understand the issues relating to use of church property by homeschooling communities and its real property tax exemption.”

Brown said he suspected CC knew about potential tax issues and that’s why the company had this arrangement with ADF.

Immediately after getting the bill, Brown called Robert Bortins Jr., CEO of CC, which is based in North Carolina.

In an interview with The Roys Report, Brown said he told Bortins: “You came into our facility. You knew that this would cause me some tax problems . . . You dealt with me unethically, and I sure hope you change in the future how you deal with churches. Be right up front.”

Brown said Bortins responded by promptly paying the entire $85,000 tax assessment. Further, the county later refunded that amount after Brown personally pleaded his case to the county tax assessment board and their local CC chapter converted to nonprofit status.

Yet Brown said he felt disappointed and misled by the CC corporation. “I was blindsided by the fact that they weren’t a 501(c)(3) . . . I hope that they have amended their ways.”

But according to our months-long investigation, which included speaking with over a dozen former CC contractors, three county tax assessors in two states, and multiple outside experts, CC hasn’t amended its ways. CC continues to encourage its local contractors to ask churches to host local CC groups, but rarely, if ever, does CC fully disclose the risks to either party.

Also, Calvary Chapel Fremont isn’t the only church that has been assessed thousands of dollars in property tax because it hosted a CC program. Another church in California received a similar tax bill in 2016. And when a CC contractor tried to warn churches about what was happening, CC went on the attack.

CC did not answer questions about specific incidents raised in this report. However, CC’s hired PR firm provided a statement which reads in part: “We regularly consult with our legal and tax advisors to ensure we are acting with integrity and in compliance.”

The Roys Report also reached out to ADF to request an interview about their involvement with CC and partner churches, but ADF’s media relations contact said the legal group has no comment at this time.

Two Churches Hosting CC Groups Face Massive Tax Bills

Curriculum provider Classical Conversations Inc. runs a unique homeschooling business model, recruiting homeschool parents as directors, who then conduct weekly classes—usually in churches—using CC’s curriculum. These local groups pay reduced or even no rental fees to churches by emphasizing the “ministry” aspects of their education work.

This arrangement with churches is expressly encouraged by CC. The company’s 2020 Licensing Guide for CC directors includes over a dozen references to churches hosting CC groups including specific expectations about contracts, fees, and insurance.

CC’s handout to churches posted on their website says nothing about potential tax issues this arrangement may raise.

Yet according to Carol Topp, a certified public accountant who specializes in serving homeschool families, hosting a CC program can jeopardize the tax exemption churches enjoy.

Though property tax exemptions vary and are determined by state and sometimes county laws, she said assessors generally frown on a for-profit business, like CC and its communities, benefiting from use of tax-exempt property.

“That’s what has churches worried,” Topp said. “If they lose this exemption, it will be very expensive for them to pay property tax.”

In 2016, Fremont Presbyterian Church in Sacramento, California, discovered this the hard way.

The county assessed the church approximately $15,000 in back taxes because the local CC community was using a portion of the church building for meetings.

“Churches assume they will get the full exemption, but it’s dependent on how the property is used,” Sacramento County Chief Appraiser Jill Dolce said in a phone interview.

Two CC directors who spoke with The Roys Report said they believed that when a church charges their chapters zero rent, their weekly CC community meetings have no impact on the church’s property tax exemption.

CC director Annie Ferguson of Niceville, Florida, added that avoiding tax issues was a main reason that the churches, which have hosted her CC chapter, have not charged her rent.

Yet numerous government officials told The Roys Report that the amount of rent a church charges a CC chapter has no bearing on whether the church is assessed any related property tax.

Margie Wing is a senior specialist property appraiser with the California State Board of Equalization, which enforces property tax laws statewide. In a three-page memo obtained by The Roys Report, Wing states that any time a church allows a for-profit group to use facilities, even if “incidental and religious in nature,” property taxes can be assessed.

“The portion of a property used by a for-profit organization at a church will jeopardize the church’s exemption on that portion, whether or not the church allows use of the property with or without a fee,” Wing writes.

CC Denies Tax Assessment Issues Have Occurred

Despite these documented cases, CC has denied that churches hosting their local communities have been assessed property taxes.

“We have not had any issues (with) churches getting fines or anything like that,” said CEO Robert Bortins Jr. last year during a webinar for CC directors. “We are above board in everything that we do.”

After reading a transcript of that webinar, Pastor Brown responded: “This is blatantly false. (CC is) possibly meeting legal standards of disclosure, but not ethical standards. As Christians, we have a higher obligation.”

When Bortins granted a brief interview last fall, I challenged him about his “no fines” claim. He clarified his remarks, stating CC’s corporate office covered charges assessed on the churches.

Bortins claimed his webinar statement as factual because the churches were “not financially responsible for that amount,” he said. “(We) worked with them and got that issue resolved. We’ve never had any facility have to pay any sort of taxes.”

The local CC chapter at Fremont Presbyterian Church seems to have solved its tax issues by converting into a nonprofit organization.

Attorney Michelle Adams of Boise, Idaho, who specializes in nonprofit law, said most states allow for-profit groups to refile their founding documents and convert to a nonprofit. CPA Topp concurs that such a move has helped other homeschool groups resolve similar cases.

However, Adams said that income a church receives unrelated to its tax-exempt purposes—even from a nonprofit—could cause issues.

“It’s a commercial activity to deal in the rental business,” she said. “But different states have different approaches to this.”

The CC chapter that met at Calvary Chapel Fremont also incorporated as a nonprofit in 2018. However, the county assessor’s office still challenged whether the CC group’s use of the church was valid since the county did not consider “educational usage” as “worship.”

Brown said when he met with the county assessor’s office in Oakland, he advanced a novel argument that caused the county to refund the taxes.

“I asked: ‘Are you now theologians to tell the church what is and what is not worship? We have a mandate from the Lord to educate our kids, and every act of obedience is an act of worship.’”

When sending the refunded amount back to CC, Brown restated his argument in a letter to Bortins, who requested permission to share the letter with the CC network.

However, Brown was not aware of the context in which his letter was shared on last spring’s webinar—as Bortins used it to claim that churches being assessed taxes was a “non-issue.”

In 2020, a CC representative in North Carolina tried to use Brown’s same argument with his local taxing body, but it did not work.

Responding with a five-page FAQ document, North Carolina tax administrator Jeremy Akins wrote: “Great lengths are taken to clearly describe who may benefit from religious exemption. Merely being a ministry, a Christian organization, etc. is insufficient, you must be a church body.”

Similarly, California statewide tax assessor Margie Wing stated that whether CC’s religious-based instruction aligns with a church’s mission does not guide her board’s evaluation.

“Regardless of the nature of the subject, the for-profit aspect of an organization is the determining factor whether an exemption can be granted,” she stated.

CC Silences Concerned Parents

Some CC directors and contractors have realized the potential risk CC poses to churches and have sought to warn them. In response, CC’s hired law firm has sent cease-and-desist letters.

A mother of two, April Palmer was recruited in 2014 to be a tutor at the CC chapter in Austin, Texas. Like most CC groups, it met weekly at a local church. Palmer was expected to sign a tutor’s contract, which included a confidentiality agreement, a standard process for all who work with the curriculum provider. However, Palmer never signed a contract, and she still became a paid CC tutor for one year.

By May 2016, Palmer had learned about potential liabilities that churches incur by hosting local CC groups. Then determined to leave, she also set out to inform local congregations that they may be at risk.

Palmer sent emails to 10 churches in the Austin area on May 18, 2016, stating in part: “Some churches are not aware that these CC homeschooling communities are for-profit businesses. I am doing my best to let the churches in my area know, because hosting a for-profit business could have tax consequences for any non-profit church.”

Officials at CC headquarters near Raleigh, N.C. became aware of these e-mails. Two weeks later, Palmer received a certified letter from corporate law firm Ward and Smith, P.A.

In heavy-handed legalese, the letter warned that CC would seek “injunctive and monetary relief for the irreparable harm you have caused.” Attorney Deana Labriola wrote: “Classical Conversations demands that you immediately cease . . . from spreading misinformation to others, including without limitation churches and individuals that have partnered with (CC).”

Four days later, Palmer agreed via correspondence to “stand down” and not send further e-mails.

This cease-and-desist episode launched Palmer into an in-depth examination of Classical Conversations and its business model. Two years later, she published a full account of being strong-armed by CC’s threatening letter. (At least one former CC director has also received a cease-and-desist letter from CC, according to Palmer and former CC area director JJ Veale, who claim they’ve seen the letter.)

Palmer has since joined an online campaign to raise awareness of CC issues, including participating in a Facebook group with thousands of past CC contractors—including former tutors, directors, and higher-level representatives.

In reporting a survey last year of CC directors, Bortins said that the “number one issue” reported by directors was the “business training aspects” of CC programs.

Bortins did not explain what these “training aspects” were, but he quickly dismissed concerns raised by whistleblowers, stating: “Some moms . . . thought that maybe we were doing some things wrong and didn’t really understand what the law (meant).”

Will CC Reform Business Practices?

Insiders such as CPA Topp, who have followed CC for years, worry that dozens, or even hundreds, of other churches may be at risk but don’t realize it.

Topp remains skeptical that CC will reform business practices: “They’re doing quite well financially, so why would they change?”

Similarly, Palmer expressed doubts that CC will change its policies. “I would never lose hope that CC could be a force for good,” she said. “Realistically, I don’t think it will happen. They would have to completely overhaul their business model.”

For his part, Brown affirms how the education company “made it right” when his church faced a massive tax assessment—even as he calls them to a higher standard.

“They were unethical upfront (and) CC has some corners they need to light up,” Brown said. “There should be no surprises and no blind sides.”

Freelance journalist Josh Shepherd writes on faith, culture, and public policy for several media outlets. He and his wife live in the Washington, D.C. area with their two children.

Freelance journalist Josh Shepherd writes on faith, culture, and public policy for several media outlets. He and his wife live in the Washington, D.C. area with their two children.

19 Responses

Ahhh nothing says Christian like the profit motive and pure godly intimidation. It’s that way because jesusssss isssss lordddd. More wolfs in sheep’s clothing and BTW pastors of the world. May I suggest . . . do some due diligence instead of saying (oh they are such strong godly men and woman). If I was the tax guy I would have said . . . next time do more diligent research with the trust people gave you and money.

If you were the tax guy? A person can dream, right?

Ugh. More unethical behavior from Christians. Great investigative article. Thanks for all your work.

You must be used to unethical behavior

Just because a left-wing county government hostile to home schooling sends a church a tax bill doesn’t mean the church owes any money. Check with a lawyer. Presumably the property tax would be pro-rated based on the percentage of income or of usage that was for-profit, or using the amount of rent that the group would have to pay on the open market. If it’s one meeting a week, that’s peanuts.

@Erasmuse: The law & what is “permitted usage” stated therein is what determines the tax liability. Prorating may not be applicable if the law states an all or nothing presumption. Even if the for-profit is “only” using the building for 8 hours out of 168 in a week & for 24 weeks a year, the tax bill is for the entire property because the non-profit tax exemption is violated.

Exactly, it’s amazing judging by the posts on this article how easily the “church” rolls over for Caesar. I am sure these same people will be reporting you for not wearing a mask.

CC doesn’t even remotely sound like the type of hill any Christian church should be willing to die on.

THIS report is spot on! As a former CC director (CC community Business owner), I can attest that this is truth. Every bit of it and more. I am a conservative and I love homeschooling. I love Jesus and HIs CHURCH more. CC is a $100 million for-profit Corp that exploits the CHURCH.

CC really should be investigated by various states (and maybe the Feds) for this. I suspect this is way they can dodge all kinds of financial and legal responsibilities..

Ironically, 501(c)(3) is not needed by churches to maintain tax free status, because all churches are tax free and can not be prohibited or abridged by the government or their agencies. It isnt a coincidence that the government prevents 501(c)(3) registered churches from political speech. In one unconstitutional swoop 501(c)(3) allows the government to define religious practice and limit free speech, it is a masterful scam by the State to control people of faith.

Give the Biblical and Constitutional reasons why you think churches should be tax-free Remember what Jesus said about rendering of taxes unto Caeser? You will be hard-pressed to argue that tax-free or not somehow prohibits the free exercise of religion per the 1A. But then I suspect you cannot.

This is incredibly biased, and full of a lack of information and is more a scare tactic than anything else. Laws vary by county and state a blanket statement cannot be issued for the whole country based on fear… Also, of note – the evidence included can include homeschool groups other than CC, meaning how do we know that this is just CC groups that got these churches in financial trouble with the state? And if we are talking about homeschooling groups, why not talk about every other event held at churches – weddings, funerals, concerts, , etc….. all of these are events that use churches. So does that mean that while a few are going after CC that they are going after all other groups? Or is it just CC Because I mean how biased would it be to just go after CC groups? Oh and I’ll requote from the same article above –

“Though property tax exemptions vary and are determined by state and sometimes county laws.” So I am still left to wonder why anyone would mail letters to every church specifically hosting a CC across the country making a blanket statement that had absolutely no bearing because the author of these letters, as well as the information above – these determinations can only be made on local county and state levels…not by one person deciding it all for everyone…

Also, all I can find on CC’s worth is that it is between 10 – 15 million – not the over dramatized amount of $100 million.

Again, the bias dripping from this article is so much so that hopefully many people can see through it and do their own research

Olivia, Much of your comment does not reflect what is in the reporting in the article above (for instance, the value of the company is not addressed here.) It would have been valuable to hear from any representative of Classical Conversations Inc., but no one has been willing to go on-the-record for months despite repeated attempts.

As to weddings or funerals, those activities are germane to a church’s purpose as nonprofit attorney Michelle Adams addressed.

She said that income a church receives unrelated to its tax-exempt purposes—even from a nonprofit—could cause issues.

“It’s a commercial activity to deal in the rental business,” she said. “But different states have different approaches to this.”

Olivia Garden – this is a comment from the Facebook group Let Us Reason – For Real. I have slightly edited it for length, but it may help you understand the amount of $ floating through this company:

It has been placed on my heart lately to really examine the income that is being generated in our churches. I kept seeing discourse that not that much money is made in the churches, but I really felt led to study the monies that are flowing through our Lord’s church.

The majority of CC campuses meet at churches. I think we can all agree on that. No church space = no CC for many campuses. Our churches are integral to the success of CC.

I read a blog posted here last week [https://www.stealingfaith.com/2019/07/01/riding-fences/ ] and I completely agree with her sentiment that most of us do not realize the millions being made in our communities because we see nothing close to it. Thinking about it all has led me to believe it is important to take a hard look at the commercial activity and the value of that commerce being done in our churches. I am not biblical scholar and consider myself constantly learning, but I have felt this unease and felt led to share.

Please see the notes below on the calculations, assumptions, and figures used to come up with these estimates.

Our churches allowing communities to use their space (in many instances for free or low-cost) are integral to generating an estimated $20,000,000 for CC Corporate each year.

Additionally, it is estimated that another $67,000,000 is being paid to a bunch of individual businesses (tutors and directors) within the churches as well. A total of $87,000,000 is being generated in our churches yearly and is split between the business of CC corporate, the business of the director, and the business of the tutors.

Averaging out the number of communities, a total of $34,884 AVERAGE per community is generated in our churches for a CC year. That is not “almost nothing” or “not much money” as it is often described and justified. TO quote another, if your profit is indeed that low it is because 1) the business model is set up to not allow you to actually be profitable or 2) you spend to much on expenses and didn’t do so great at the business management.

Let’s just look at those numbers. Do you begin to feel uneasiness at that kind of money being generated in our churches? What do you think Christ would say about that?

It is really eye opening since we often hear things like “barely getting by”, “this is ministry, not something you do for money”, “no one is making millions” or “just a bunch of homeschool moms” as phrases thrown at us and we just do not realize that indeed almost ninety million dollars in commerce is occurring in our churches.

On that note, we need to speak with integrity and stop describing ourselves as just a bunch of homeschool moms getting together or Moms who use CC curriculum. CC Campuses are a collection of businesses (in most cases – some tutors are employed) and the figures show that it is significant monies that are being paid and collected. I believe it is disingenuous to represent ourselves otherwise. True, the average director and tutor does not see much for their time, often much less than a minimum wage and it is often requested to view it as a ministry, but it does not change the fact that the tens of thousands of dollars of commerce is taking place on our church. Yet, we tend to excuse it.

Why do we allow reasoning that CC has this special seemingly protected and elevated status that makes it okay for them, but not other Christian aligned businesses? Do we want to see CFA in a church? Do we see LifeWay bookstores in churches? How about Hobby Lobby? Do we really want to see churches used this way and argue it is their right to have businesses generating millions and millions of dollars in their walls and all the missions align? I don’t want to see that.

Are those businesses qualified to have tax-exemptions on their properties? If a director purchased her own building for her business, would we see it be granted a property tax exemption? (sorry, rabbit trail there).

All my opinions and my calculations are indeed based on limited data posted by CC on their site and are certainly subject to inaccuracy because of that limit, it remains food for thought.

I am not asking you to agree with me at all. I am asking you to independently think about it and study God’s word on this. Reread the section on the cleansing of the temple. We should really take pause and let that sink it. For a moment forget all the benefit you get from CC and just listen.

Would the average church member be pleased to hear their building (which presumably they helped finance) was used as part of a whole to make a corporations tens of millions? I would think not.

I am not asking anyone to change their mind. I am asking you to think through it for yourself, ponder, and pray. Is this what God has in mind for his church? The commercialization of “making God known.”

I do ponder how Jesus would react. I am not standing here saying I am exclusively right and my thoughts are the only thoughts. I know we all can have different things revealed to us as we spend time in His word, but I do hope that hearts are open what God may want to reveal to you.

This writing is my opinion, but I hope some may find it helpful to ponder along with me.

***** Calculation Discussion *****

(As of May 14, 2019)

Just for disclosure, my calculations do include assumptions and are made in good faith on the data / information available to me and some logical guesses. I do not intend them to be presented as facts of certainty, but as logical estimates for discussion purposes. My work and assumptions are detailed below. Calculations are based on the current numbers, using the new fee structure and are indicative of GROSS profit.

Also, this does not include California numbers, which have application fees of $215 and tuition of $365.. It was impossible to guess the data size, so to be conservative and for ease, I used the numbers for the rest of the country.

CC Corporate site states that they have:

125,000 students.

50,000 families.

2,500 communities,

19,000 Tutors and Directors

It is estimated, based on information provided to me, that the numbers break down as follows:

About 74,000 Foundations students

About 25,000 Essentials students

About 24,500 Challenge students

Using 50,000 families, our average family size is 2.5 children per family (this is applicable to calculating our application fee). I do believe a more accurate representation is 3 children per family in Foundations, 1.5 children per family in Essentials and 2 children per family in Challenge. Please note, that is based on my experience and discussions along with evaluating the trends I saw on campus. I am using these for my calculations to try and be conservative and accurate.

Foundations:

$145 / 55 Application Fee (first student / subsequent students) – goes to corporate

$335 Tuition (split between tutor and director)

$60 Supply Fee (used to pay for supplies, but I have been informed it is income to the director)

Essentials:

$145 / 55 Application Fee (first student / subsequent students) – goes to corporate

$335 Tuition (split between tutor and director)

$30 Supply Fee (used to pay for supplies, but I have been informed it is income to the director)

Challenge:

$125 Application Fee – goes to corporate

$1375 Tuition (split between corporate and director – $160 each semester to corporate for a total of $320 to corporate and $1055 to director) , NOTE: this breakdown was provided to me, but as it is not first hand as I am not a 2019 director, there is always possibility for error in this amount)

$60 Supply Fee (used to pay for supplies, but I have been informed it is income to the director)

Using the average family size noted above and for further discussion purposes, our average application fee for Foundations is $85 and for Essentials is $115.

CORPORATE INCOME FROM CAMPUSES:

Application Fees (based on average fee) for Foundation Students: 74,000 x $85 = $6,290,000

Application Fees (based on average fee) for Essentials Students: 25,000 x $115 = $2,875,000

Application Fees for Challenge Students: 24,500 x $125 = $3,062,500

Corporate Portion of Tuition Paid for Challenge Students: 24,500 x $320 = $7,840,000

CORPORATE GROSS INCOME: $20,067,500

AVERAGE CORPORATE INCOME PER COMMUNITY: $8027.00

TUTOR / DIRECTOR INCOME FROM CAMPUSES:

Tuition Paid for Foundation Students: 74,000 x $335 = $24,790,000

Supply Fee Paid for Foundation Students: 74,000 x $60 = $4,440,000

Tuition Paid for Essentials Students: 25,000 x $335 = $8,375,000

Supply Fee Paid for Essentials Students: 25,000 x $30 = $750,000

Director Portion of Tuition Pad for Challenge Students: 24,500 x $1055 = $25,847,500

Supply Fee Paid for Challenge Students: 24,500 x $60 = $1,470,000

DIRECTOR / TUTOR GROSS INCOME: $67,142,500

AVERAGE DIRECTOR / TUTOR GROSS INCOME (19,000 tutors and directors): $3,533.82

AVERAGE DIRECTOR / TUTOR INCOME PER COMMUNITY: $26,857

TOTAL INCOME (CORPORATE, DIRECTORS, TUTORS): $87,210,000

AVERAGE INCOME PER LOCATION: $34,884.00

OTHER INTERESTING POINTS:

CORPORATE income on Foundation students Application fees is estimated to be $6,290,000.

DIRECTOR income on Foundation students is estimated to be $9,916,000

CORPORATE income on Essentials students Application fees is estimated to be $2,875,000.

DIRECTOR income on Foundation students is estimated to be $2,512,500

TOTAL CORPORATE income on Foundations and Essential Students is estimated to be: $9,165,000

TOTAL DIRECTOR income on Foundation and Essentials Students is estimated to be:

$12,428,500

Estimates show that corporate makes almost 75% (actual is 73.7%) of what a director makes in an F/E program (and MORE if you are just looking at Essentials).

Again, all my opinions and my calculations are indeed based on very limited data posted by CC on their site and are certainly subject to inaccuracy because of that limit though I did my best to try and most accurately represent what I believe to be good assumptions and calculations.

Dear Josh,

How can CC be knowingly misrepresenting truth when they have this on their website, accessible through a one easy google query.

“How is Classical Conversations structured?

Classical Conversations is a for-profit business, with the purpose of cultivating consistent classical Christian homeschool community leaders. Directors are licensees and receive a license to use our brand and copyrights to offer services and materials within the licensed CC programs. Classical Conversations also has sales team members that make commission on every sale. As the local Directors and sales leadership are successful, so is Classical Conversations’ home office.

How does Classical Conversations comply with tax and property tax laws?

Classical Conversations, Inc., has always complied with all IRS tax laws and was audited in 2019 for the 2018 tax year, in which we were found to be above reproach. We regularly consult with our legal and tax advisors to ensure we are acting with integrity and in compliance. As Proverbs 15:22 states, “Plans fail for lack of counsel, but with many advisers they succeed.”

For hosting facilities: We know that property tax laws vary not only by state, but by county and even municipality, so it would actually be impossible to know all the tax laws and administrative rules. Still, hundreds of thousands of students have been learning in licensed CC communities hosted by churches and other facilities over more than 20 years.

Many tax assessors have determined that families who wish to use church facilities as meeting spaces are able to do so, as our faith-based curriculum helps to further the primary and principal use of each church property, religious worship. Christian-based education offered through homeschool communities constitutes worship and supports the religious purpose associated with the use of church property.”

For reference:

https://cchomeoffice.com/business-practice-faq/

Tax laws like these are almost always in as state of contest and geographic complexity… After reading the article it seems that this tax situation is muddy enough to say that your claims of “misrepresentation” could also simply be an uncharitable way of denying the responsibility of Churches to understand the situation of a third party using their space *or* not taking into consideration the ways laws like these seem to be “under contest” (was it the failure of the CC chapter to know and make known their situation in particular, or Brown’s failure to do a quick google search?)

I wish this article was about exposing draconian tax laws instead of criticizing CC. Why is it that letting the operatives of a for-profit christian education platform use your space (for free) calls into question the tax-exempt status of your space? For instance again, this statement “The CC chapter that met at Calvary Chapel Fremont also incorporated as a nonprofit in 2018. However, the county assessor’s office still challenged whether the CC group’s use of the church was valid since the county did not consider “educational usage” as “worship.””… That’s worth fighting over with the county assessor, because it is so laden with worldview assumptions that are contrary to our own faith. Education *is* discipleship, always. (Ephesians 6:4)

There is also the whole reality of the question of how the org runs… apparently there are chapters that are non-profits and those that are not… and apparently to mitigate liabilities, chapters *can* and have been at times converted to non-profit chapters to avoid the tax risk… why is that not a viable solution? What is the ethical dilemma there? I don’t think its unethical to be clever in how you work within draconian tax laws…especially where they are make assumptions about whether education is “worship-related” or not (like seriously, how dare they?) I also found it hilarious that the pastor in question was so shocked and finger-waggy at CC, even though CC found a solution to make it right – and they didn’t have to pay taxes!! “Brown affirms how the education company “made it right” when his church faced a massive tax assessment”. In my opinion his ignorance is culpable and embarrassing. I’m a pastor, and I would literally feel like such a fool to be Brown. Like, apparently that guy can’t even do a Google search – our pastors need to be more sharp in a secular situation such as ours.

Honestly, that whole ‘Brown” situation puts more points on the board for CC for me. That is the kind of Org I would want to work with when endeavoring upon the subversive act of christian education in a secular situation that can barely tolerate it. If they have to be for-profit, and flexibly ‘non-profit’, in order to best support this subversive act… more power to ’em).

As for the silenced parents… there was not possibly enough information shared about the situation to really understand why the legal letter was sent to Palmer for instance. Was she raising concerns in a state/county where the tax law didn’t actually pose a threat? Is there any reason why Bortins statement that “Some moms . . . thought that maybe we were doing some things wrong and didn’t really understand what the law (meant).” Wasn’t accurate in particular instances like Palmers and why the email wasn’t warranted? Can you confirm the tax law situation in Austin for us?

The statement on their website above seems to be pretty indicative that a blanket statement about tax liability simply isn’t appropriate, nor should it be. Unfortunately the complex nature of our tax laws doesn’t allow for a blanket statement that wouldn’t also potentially be harming to CC. If I told a local Churches on facebook, for instance, that they risk being held liable for property taxes when hosting CC, when in fact I didn’t understand the reach of my communication or the fact that tax laws are different in County X and County Y though they happen to share a border in my local vicinity…counties (for instance)… should I be held liable for misinformation that potentially harms CC because I don’t know the tax laws for each county and don’t know that in County Y it’s totally fine? See the complexity? Where the you and the Roys Report seem like you’ve simplified things, all you have really done is eroded my trust in CC by fooling me into thinking the situation isn’t complex and that ‘everyone understands’ our tax laws because they aren’t draconian after all…

Alas… as you can probably tell! I found your article to be rank with smear primarily motivated by some kind of ideological stance (as I do most of the Roys Report articles I’ve engaged with).

Hello Mr. Harris,

The story above includes over a dozen sourced links and nearly as many firsthand sources quoted. To reply to a few specific comments:

1. // Brown’s failure to do a quick google search //

Classical Conversations’ Business Practice FAQ page only went live in December 2019, according to multiple reports from former CC directors. Pastor Tim Brown could not have Googled and found the information in 2018 when the tax assessment incident occurred at his church.

2. // A blanket statement about tax liability simply isn’t appropriate (for CC) //

It would be entirely appropriate for Classical Conversations Inc. to disclose the statements that tax assessors in North Carolina and in California (both linked above) have made regarding the specific issue of faith-based homeschooling groups using tax-exempt church spaces. Though various states and counties have some differing policies on tax assessment, both a CPA and nonprofit lawyer state in the story how there are broad guidelines that apply across the U.S.

3. // Your claims of “misrepresentation” //

The article documents specific CC statements that are “blatantly false,” to quote Pastor Tim Brown. Nearly five years later, the potential risks are still not being fully disclosed to either CC local directors or CC partner churches according to all evidence. See https://info.classicalconversations.com/churchesandpastorappreciation and PDF handout on that page: https://docdro.id/I6kBWRY

4. // Apparently to mitigate liabilities, chapters *can* and have been at times converted to non-profit chapters to avoid the tax risk… why is that not a viable solution? //

The story reports (paragraph 35) that this is a “viable solution” for many local CC chapters, though an expert source also states this is not a solution in every case.

5. // I wish this article was about exposing draconian tax laws instead of criticizing CC. //

The relationship of church and state is surely complex, as theologians over centuries have stated. Christian author John Piper gives a survey of these issues in his article, “Obey the Government for God’s Sake.” https://www.desiringgod.org/messages/obey-the-government-for-gods-sake

There are instances when Christians have made intentional decisions to disobey state laws. That is a different matter than a church seeking to comply with state and local laws, yet being thwarted in that. In these cases, churches did not comply because, according to all available evidence, CC Inc. withheld guidelines and guidance that could have assisted them.

6. // I found your article to be rank with smear primarily motivated by some kind of ideological stance. //

Representatives from CC and ADF were contacted multiple times to ask for their comment, including a list of more than a dozen specific questions to CC Inc. Both organizations declined to comment, though CC’s statement (almost identical to one provided months ago) is included in the story. https://docdro.id/ncBKRI6

What motivates the article is an attempt to report the truth and raise awareness of these issues to all churches and Christian non-profits that desire to operate truly “above reproach.” I hope these replies are helpful.

R. Harris –

You point out that the information is on the website. As a former director who directed for 9 years, I can clearly state that this information was not shared prior to about a year ago, well after the “Lettergate” scandal (letters describing this property tax risk were anonymously sent to every church hosting a CC community). After corporate peddled ADF membership to churches to help – which was completely ineffective because ADF clearly states on their website they don’t help with property tax issues – they belatedly posted the page you reference. Directors were not notified, they had to stumble upon the information on their own. Some did, but the reality is the majority of Directors are already consumed to the Max with child rearing responsibilities and rarely peruse the corporate webpage looking forward information that should have been broadcast widely.

Another point – you said “why not just convert to non-profit for communities?” and that’s a really great question.

I believe there are – two? – non profit communities in the US, both in California, and then Washington state has a dummy non-profit available that all the communities work can join.

So obviously, since it’s been at least 5 years since Washington started their stuff, the non profit may be a viable option but it’s not one that’s being promoted or we’d see MANY more communities available. So the lack of support and promotion for this option from corporate tells me that it’s not really an option at all.

*IF* education is truly ministry, why doesn’t CC corporate become non-profit themselves? Easily answered from an outside perspective – because of control. CC is the Bortins family business and they don’t want to offer control to a non-profit board. That’s entirely understandable and within their rights as US citizens. However, they are damaging local churches and risking local Directors – plus their middle man administrators with their choice.

It’s very sad.

The reason CC community businesses don’t “just convert to nonprofits” is bc they can’t stand the transparency/scrutiny (financial and ethical) that a true nonprofit board would bring.

Former CC director